Research Article - International Research Journal of Arts and Social Sciences ( 2025) Volume 13, Issue 1

Received: 03-May-2024, Manuscript No. irjass-24-133952; Editor assigned: 06-May-2024, Pre QC No. irjass-24-133952 (PQ); Reviewed: 20-May-2024, QC No. irjass-24-133952; Revised: 08-Jan-2025, Manuscript No. irjass-24-133952 (R); Published: 15-Jan-2025, DOI: 10.14303/2276-6502.2025.104

Based on the global "carbon neutrality" agenda, several nations have pledged to cut their carbon emissions. This study uses empirical research to examine how green financing and renewable energy sources affect the carbon neutrality targets of 38 OECD member nations between 2013 and 2021. The projected results show that additional green bonds issued by the OECD would result in more significant progress toward the carbon neutrality goal. Specifically, an increase of 1% in the amount of green energy used is anticipated to enhance the objective of being carbon neutral by over 0.048%. Furthermore, among the other explanatory factors, uncertainty has the most significant magnitude of coefficient that negatively affects the OECD's carbon neutrality. Three stages of finding, investing in, and using carbon market policy will lead to developing the green financial market, digital green finance instruments, and sustainable power production. These are the main policy implications.

Analysis of green finance, Renewable energy impact, OECD, Carbon neutrality, Policy implications

Many scientists claim that one of the biggest threats to human survival in the twenty-first century is undoubtedly climate change (Chen S et al., 2020). The phenomenon, which is the result of a confluence of population growth, fast industrialization, and environmental neglect, has sparked several problems, such as the melting of the polar ice caps, an increase in global temperatures, a rise in the frequency of severe floods and droughts, and extensive deforestation (Fei J et al., 2016). As a result, several countries have committed to reducing their carbon emissions, either via autonomous projects or through international accords like the historic Paris Agreement of 2015 (Hao Q et al., 2024). The idea of "carbon neutrality," which is defined as a situation, in which the amount of carbon released into the atmosphere is balanced by the amount that is removed, is at the centre of these efforts (Jiang X ting et al., 2018). This is accomplished through policies and technologies that promote the use of green energy, technological advancement, and increased energy efficiency (Li R et al., 2023). An increasing number of nations have expressed bold plans to become carbon neutral within specified time constraints (Li R et al., 2023). As an example, Japan said in October 2020 that it would achieve carbon neutrality by 2050, outlining a plan based on structural changes, industry reorganization, and significant expenditures in environmentally friendly innovation (Lu S et al., 2021). This commitment is especially important in light of Japan's high reliance on the use of fossil fuels, which amounted to about 2.5 million barrels of imported crude per day in the same year (Ma Q et al., 2023). Japan is a significant emitter of greenhouse gases, with emissions reaching nearly 1150 MtCO2 in 2021 (Pata UK et al., 2024). Similarly, the United Arab Emirates (UAE) stressed the increase of portfolio while announcing its intention to attain carbon neutrality by 2050 during Expo 2020 in Dubai (Song X et al., 2023). President Jair Bolsonaro of Brazil said in 2021 that his nation will become carbon neutral by 2050, emphasizing the strategic use of hydropower and other renewable energy sources (Wang P et al., 2019). India, a country that struggles with being highly polluted and densely populated, has set a long-term goal of being carbon neutral by 2040 and attaining net-zero emissions by 2070 (Wang Q et al., 2023). These pledges highlight the view held by countries that compliance with global accords and the quest for carbon neutrality may act as stimulants for economic development, innovation, and productivity in several areas (Wang Q et al., 2023). A group of countries distinguished by their industrialized and developed economies make up the Organization for Economic Cooperation and Development (OECD) (Wang Q et al., 2019). The OECD's member nations have made progress in tackling environmental issues throughout time, especially regarding carbon dioxide emissions (Wang Q et al., 2018). A portion of this decrease may be ascribed to member nations putting environmental legislation into practice. Nevertheless, other variables like the COVID-19 pandemic in 2019 and the worldwide economic downturn brought on by the 2008–2009 financial crisis also had an impact on emissions levels (Wang Q et al., 2023). Several important OECD economic sectors are significant contributors to Greenhouse Gas (GHG) emissions, including the energy sector, transportation, manufacturing, aims have been set on finding effective ways to reduce carbon emissions, with a particular emphasis on putting reduction regulations into place and encouraging sustainable practices in a variety of industries (Wang Q et al., 2023). Among its member nations, the OECD has taken the lead in encouraging green growth and sustainability programs (Wang Q et al., 2022). Launched in May 2011, the OECD Green Growth Strategy is a prime example of the organization's dedication to supporting ecologically sound economic growth in addition to the Green Growth Strategy, is essential to the organization's goal of having net-zero greenhouse gas emissions among its member nations by 2050 (Wang Q et al., 2020). In line with global frameworks like the United Nations Framework Convention on Climate Change (UNFCCC) and the Paris Agreement, IPAC supports OECD members in their efforts to advance cohesive green policies, exchange best practices, and strengthen their capacity to effectively combat climate change (Wang Q et al., 2018). The OECD member nations work together via IPAC to design and carry out policies meant to accomplish their climate goals while promoting sustainable economic development. All things considered, the OECD's member nations have shown their dedication to leading the way in the design, execution, and creation of laws meant to lower carbon emissions and advance sustainability. With the help of programs like IPAC and the Green Growth Strategy, OECD member nations are well-positioned to take the lead in the world's shift to a low-carbon economy. In addition to providing a sustainable substitute for fossil fuels, renewable energy sources such as biomass, solar, wind, and hydroelectric power also significantly lower greenhouse gas emissions. Since renewable energy technologies allow nations to disentangle economic development from carbon-intensive energy sources, their adoption is essential to meeting carbon neutrality ambitions. Reducing dependency on fossil fuels and lessening the negative effects of climate change require raising the proportion of renewable energy in the energy consumption mix. The purpose of this empirical research is to look at how renewable energy sources and green funding affect the OECD member states' carbon neutrality goals.

We want to provide empirical insights into the link between these factors and carbon neutrality outcomes by examining data from 2013 to 2021. In particular, we use a new metric that academics have developed, the carbon neutral capacity Index, as the dependent variable in our empirical model. We also analyze the effect of uncertainty on carbon neutrality, taking into account possible consequences for the formulation and application of policies. The goal for all OECD members to become carbon neutral by 2050 calls for a customized strategy that takes into account the distinctive resources and infrastructure of each country. As an example, Denmark has the lowest carbon intensity of any OECD nation, as well as the largest GDP share of green taxes and a strong rate of eco-innovation. In a similar vein, Germany has laid out plans to significantly raise its output of green electricity, from 17% in 2020 to almost 80% by 2050. With a reputation for being at the forefront of green technology, the US has set high goals, such as reducing greenhouse gas emissions by 50–52% by 2030. Aiming to achieve carbon neutrality by 2035. Reaching these goals requires putting effective tools and policies into place that are suited to the specific needs of each nation. Previous research has shown that because of their low yields and sluggish returns, environmentally friendly enterprises often struggle to get funding. As a result, governments and the corporate sector can be reluctant to fund such initiatives. To solve this problem, strategies such as lowering investment risk, offering investment assurances, and boosting investment efficiency must be used to increase investor interest in environmental initiatives. Using financial instruments like green bonds has been one of the most important ways to finance ecologically friendly initiatives in recent decades. Globally, the green finance industry is expected to reach over 22480 billion US dollars by 2031, up from roughly 3650 billion US dollars in 2021.

There is considerable potential to improve the green finance markets' efficiency in OECD member nations, which would help to promote green initiatives. Green finance is a vital means of fostering financial inclusion among OECD members by stimulating investments in projects that promote environmental sustainability. The purpose of this research is to examine how the use of renewable energy sources and green financing affects the OECD member states' carbon neutrality goals. In light of this, our study adds to existing research in two main ways. To begin with, it creates a new Carbon Neutral Capacity Index for OECD members based on a proposal from Pata et al., and uses it as the dependent variable in the empirical model. Second, this study examines the effect of uncertainty on carbon neutrality among the explanatory factors, offering insightful information for future debate. Increasing the issuance of green bonds in OECD nations is anticipated to drive more progress towards reaching carbon neutrality objectives, according to the predicted results using the Generalized Moment Method (GMM). Furthermore, and the encouragement of sustainable power production via all-encompassing carbon market rules are the main policy implications derived from these results.

The body of research on renewable energy, carbon neutrality, and green financing in the framework of OECD member nations provides a thorough analysis of the potential problems related to the shift to low-carbon and sustainable economies. The idea of carbon neutrality is essential to these efforts. Global action toward this aim has been sparked by the 2015 Paris agreement and other international accords, such as the conclusions of COP 26, with many nations establishing aggressive goals for reaching carbon neutrality mobilizing financial resources for ecologically beneficial initiatives is a crucial step towards reaching carbon neutrality. One of the main challenges to advancing green projects is the shortage of funding. Diverse financial tools and processes have been devised to tackle this problem, with green bonds emerging as a noteworthy vehicle for funding ecologically friendly initiatives. Recent years have seen a notable increase in the field of "green finance," which includes a variety of financial services and products aimed at assisting these kinds of initiatives. The size of the worldwide green finance industry is expected to continue growing in the next years, with a value estimated to reach approximately 3650 billion US dollars in 2021. There is significant potential to improve the performance of green finance markets in OECD member nations, which would speed up the shift to carbon neutrality. Because renewable energy sources reduce dependency on fossil fuels and mitigate greenhouse gas emissions, they are essential to reaching carbon neutrality objectives. Several nations, including Finland, Sweden, Germany, and the US, have put ambitious plans into place to raise the proportion of renewable energy in their energy mix. Germany, to decarbonizes its energy sector, plans to increase the amount of green electricity it generates from 17% in 2020 to around 80% by 2050. In a similar vein, the US has set ambitious goals to cut greenhouse gas emissions, hoping to do so by 50–52% by 2030. Sweden is aiming for 100% green power production by 2040. These programs emphasize the value of renewable energy in the move toward carbon neutrality and the need for sensible laws and financial support in this field. The effects of renewable energy and green financing on the OECD member states' carbon neutrality goals have been the subject of a recent study. Research has used several approaches to evaluate the efficacy of distinct policy initiatives and financial tools in advancing sustainable development. As an example, Q. Wang, Sun, Pata, et al., suggested a new carbon neutral capacity index for OECD countries, which functions as a thorough gauge of advancement toward carbon neutrality. Researchers have investigated, and carbon neutrality results using empirical models like the Generalized Moment Method (GMM). According to the research, there is a positive correlation between achieving carbon neutrality objectives boosting the issue of green bonds and encouraging the use of renewable energy. Nonetheless, there are still a lot of unanswered questions about how uncertainty affects carbon neutrality and how to establish and execute policies. In general, the literature emphasizes how crucial it is to include renewable energy and green financing in the national strategy to achieve carbon neutrality. The adoption of renewable energy may be accelerated by OECD member states via the use of financial tools, uncertainty reduction, and addressing renewable energy adoption.

Data, theory and empirical model

Theoretical baseline: Theoretical frameworks that form the basis of research on renewable energy, carbon neutrality, and green finance provide important insights into the intricate processes and linkages influencing the shift to sustainable economies. These frameworks are based on the understanding that climate change is a global issue requiring immediate response. To keep global warming to well below 2 degrees Celsius above pre-industrial levels, the Intergovernmental Panel on Climate Change (IPCC) has emphasized the need for significant reductions in greenhouse gas emissions, underscoring the significance of reaching carbon neutrality. Based on this foundation, scholars have created theoretical models to examine the motivations behind and effects of policies meant to advance sustainable development and carbon neutrality. The idea of environmental economics, which stresses the incorporation of environmental factors into economic decision-making processes, is one well-known theoretical framework that directs study in this field. The idea of externalities is crucial to this approach because it draws attention to the sometimes overlooked costs and benefits connected to environmental preservation and destruction. Environmental economics provides a framework for understanding policies aiming at attaining carbon neutrality, emphasizing the need to internalize externalities and match economic incentives with environmental sustainability objectives. An additional crucial theoretical foundation for comprehending the function of financial markets in advancing sustainable development is provided by the idea of green finance. A variety of financial tools and systems are referred to as "green finance" and are intended to direct funds toward ecologically friendly enterprises and endeavors. The idea of financial innovation, which refers to the creation of innovative financial services and solutions to meet particular environmental concerns, is fundamental to this approach. For instance, green bonds let investors fund initiatives that assist the environment, including infrastructure for renewable energy sources or upgrades to energy efficiency. The idea of green finance places a strong emphasis on the need to raise money for sustainable investments and matching financial incentives with environmental goals. The dynamics of switching from fossil fuel-based energy systems to renewable energy sources are explained by theories of renewable energy transition. These theories provide frameworks for examining the elements promoting and impeding advancement while also acknowledging the technological, economic, and political difficulties connected with such shifts. For example, the Multi-Level Perspective (MLP) views transitions as happening at three levels: regimes (which are already existing socio-technical systems), landscapes (which are larger socio-economic settings), and niches (where innovations originate). The use of risk management techniques, such as scenario planning, hedging instrument usage, and portfolio diversification, is essential for reducing the negative effects of uncertainty on sustainable development projects.

Data description

The data used in this research include a range of metrics pertinent to the examination of carbon neutrality, green financing, and the uptake of renewable energy in OECD member countries. Important information on a country's environmental performance, such as its carbon intensity, green taxes, and eco-innovation rates, may be found in sources like the OECD environmental performance reviews. Furthermore, official reports and policy papers provide comprehensive details on the goals and tactics of various nations about renewable energy. Among the important data points guiding the research are Finland's ambition to achieve carbon neutrality by 2035 and Germany's goal to boost its green power output to 80% by 2050. Global financial databases and publications are the source of financial information about green finance, such as the amount of green bonds issued and the size of the green finance market. Estimates of the size and development trajectory of the green finance sector are provided by studies like Q. Wang, Li, Su, et al., which give important insights into long-term trends and patterns.

The data description, which is derived from credible national publications, international organizations, and financial databases, covers a wide variety of indicators about carbon neutrality, green financing, and the adoption of renewable energy. Policymakers and scholars may get useful insights from this extensive dataset, which allows for a thorough examination of the variables impacting nations' progress towards carbon neutrality (Table 1).

The following Table 1 contains the major variable information.

| Role in model | Variable | Symbol | Unit | Source |

| Dependent variable | Carbon neutral capacity index | CN | - | Calculated based on |

| Explanatory variable | Issued green bonds | GB | Billon US dollars | |

| Renewable energy consumption | REC | Exajoules | BP | |

| Control variable | Green economy innovation index | GEII | - | Calculated based on |

| GDP per capita | GDPPC | Current US dollars | World Bank | |

| Good governance | GGOV | - |

Table 1. An initial set of variables.

Model specification

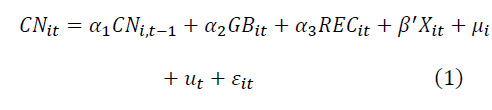

Prior environmental performance affects the empirical link among carbon neutrality modeling variables. One way to study these dynamics is with the help of the system GMM (Generalized approach of Moments) estimate approach, which has benefits such as being resistant to heteroscedasticity. Here is the econometric equation that is derived from the GMM system:

In this case, CN stands for zero emissions, whereas GB and REC correspond to green bonds and renewable energy utilization, correspondingly, serve as key variables for explanation. X stands for the control variables, which include decent governance, GDP per capita, and the green economic development index. The variables' subscripts i and t stand for the year and the state, correspondingly. Furthermore, time and location have fixed influences ut and μi.

Empirical results

For the years 2013–2021, Table 2 organizes the estimated results of the GMM system approach for 38 OECD nations (Table 2).

| Variable | Coefficient | Z-stat. | p-value |

| GEII | 0.0034 | 9.575 | 0.132 |

| GDPPC | 0.018 | 13.498 | 0.749 |

| GGOV | 0.063 | 8.798 | 0.048 |

| Lagged CN | 0.049 | 25.492 | 0.558 |

| GB | 0.004 | 176.38 | 0.103 |

| REC | 0.019 | 11.3286 | 0.004 |

| Note: Carbon Neutrality (CN), Good Governance (GGOV), Green Energy Consumption (REC), Green Economy Innovation Index (GEII), GDP per capita (GDP), and Green Economy Innovation Index (GEII) are the variables represented. | |||

Table 2. System GMM estimates outcomes.

Table 2 shows that, at the 1% significance level, this suggests that future carbon neutrality is boosted due to OECD nations' improved efforts to reduce carbon emissions. This confirms what other studies have shown: delayed environmental performance might affect present results suggesting that OECD nations make more headway towards their carbon neutrality goals when there is an increase in green bond issuance. This result aligns with previous research showing a favorable correlation between green financing and reduced carbon emissions. Because of their dependability and lower investment risks, the increased investment in eco-friendly initiatives made possible by green bonds helps achieve carbon reduction goals. One per cent increase in green energy consumption is connected with a 0.048% improvement in reaching the carbon neutrality objective, indicating a positively significant coefficient of renewable energy deployment. The significance of moving away from fossil fuels is underscored by the fact that this beneficial impact is conditional on a concurrent decrease in the use of these fuels. Beyond deploying renewable energy sources, encouraging green innovation significantly influences reducing carbon emissions in OECD nations. This highlights the need for carbon neutrality policies to place a premium on innovation in addition to using renewable energy sources. It has been shown that higher income levels are associated with increased consumption of green products and services, which in turn aids in reaching carbon neutrality. This suggests that an increase in GDP per capita positively affects carbon neutrality. While this result goes against the grain of other regional literature, it is consistent with research showing that GDP per capita positively affects reducing CO2 emissions. In addition, OECD member states may more easily reach their carbon neutrality goals if they enhance the quality of their governance. To advance carbon neutrality environmental policies, robust regulatory frameworks and political stability are essential to good governance. Existing research supports this conclusion, highlighting the importance of effective management in propelling initiatives to reduce carbon emissions. Conducting a sensitivity analysis guarantees that the findings are robust. We re-estimate the model using the GMM system, but this time, we utilize CO2 emissions instead of the carbon neutrality index variable. Carbon dioxide (CO2) emissions are one of the most prominent greenhouse gases, so this study intends to validate the green bond and renewable energy deployment coefficients. The results of this robustness evaluation are shown in Table 3.

| Variable | Coefficient | Z-stat. | p-value |

| GEII | 0.038 | 0.119 | 19.382 |

| GDPPC | -0.694 | 0 | -10.943 |

| GGOV | -0.393 | 0.048 | -14.594 |

| Lagged CO2 | -0.052 | 0.039 | -10.393 |

| GB | -0.013 | 0.074 | -22.493 |

| REC | -0.092 | 0.008 | -13.293 |

| Note: Carbon dioxide emissions, green bond issuance, renewable energy consumption, green economy innovation index, GDP per capita, and good governance are represented by the corresponding variables CO2, GB, REC, GEII, GDPPC, and GGOV | |||

Table 3. Outcomes of an evaluation of robustness (with the parameter that is dependent changed).

In OECD nations, CO2 emissions are significantly affected by other factors, even if the coefficient for delayed CO2 emissions is negligible. Several factors contribute to a decrease in CO2 emissions, including an increase in the issuance of green bonds, the deployment of renewable energy, green innovation, GDP per capita, and good governance. These results confirm the earlier empirical findings in Table 2, which showed that different policy interventions were beneficial in reducing carbon emissions. Another robustness check is performed by modifying the estimator of coefficients to confirm the findings' robustness. This study uses the panel fixed effect estimate approach with both time-fixed and individual-fixed effects considered. Table 4 displays the recalculated findings obtained from the fixed effect panel estimate (Table 4).

| Variable | Coefficient | p-value |

| GEII | 0.302 | 0.483 |

| GDPPC | 0.043 | 0.193 |

| GGOV | 0.406 | 0.003 |

| Lagged CN | 0.049 | 0.048 |

| GB | 0.031 | 0.099 |

| REC | 0.011 | 0.003 |

| Note: GGOV stands for excellent governance, green economy development index, carbon neutrality | ||

Table 4. Findings from the robustness test (changing the estimating method).

Table 4 shows that the main explanatory factors, renewable energy development and issued green bonds, have positive and significant correlations that are identical to Table 2, confirming that the empirical results are reliable.

A great deal of research has shown the significance of uncertainty in the success of CNG. A slowdown in economic growth and the effects of policies could result from increased risk-taking by economic actors brought on by uncertainty. When achieving carbon neutrality, a rise in economic volatility may make green project investments riskier, people less likely to embrace green goods, and Small and Medium-sized Enterprises (SMEs) less likely to join green marketplaces. With the estimated findings in Table 5, we can determine the effects of unpredictability on carbon neutrality for OECD nations by gathering the global ambiguity index from the global Unpredictability Index website and adding it to Equation (1) (Table 5).

| Variable | Coefficient | Z-stat. | p-value |

| REC | 0.233 | 9.844 | 0.004 |

| GEII | 0.119 | 13.73 | 0.038 |

| GDPPC | 0.083 | 6.739 | 0.063 |

| Lagged CN | 0.139 | 13.2 | 0.004 |

| UNC | 0.004 | 18.797 | 0.078 |

| GB | 0.233 | 9.844 | 0.004 |

| GGOV | 0.119 | 13.73 | 0.038 |

Table 5. Effects of unpredictability on the neutrality of carbon.

With the largest coefficient size among all factors, the findings show that uncertainty significantly reduces the carbon neutrality of OECD nations. This emphasizes how crucial it is to deal with uncertainty as a significant barrier to reaching carbon neutrality goals in these economies. Similar conclusions were drawn from recent empirical research that found that unpredictability in the economy negatively affects both the growth of green innovation and the involvement of private investors in green initiatives. Member nations have been pushed to implement a range of economic changes in response to the unpredictable state of the world economy. However, the OECD nations face substantial obstacles in attaining carbon neutrality due to the complexity of worldwide financial systems, as well as variables like the development of the corona virus illness and geopolitical tensions that have increased unpredictability levels.

Notably, a gradual decline in reliance on fossil fuels may lead to a drop in carbon dioxide emissions, which might mitigate economic instability. Oil shocks significantly contribute to economic volatility worldwide since they may seriously impair nations' financial stability and economic frameworks, especially industrialized ones that depend considerably on crude oil imports. Ever since the Arab-Israeli conflict in 1973 caused the first oil shock, nations have worked to make their economic systems more resilient to future oil shocks. However, oil shocks remain to be external risks that threaten the long-term viability and stability of the economy. Improving the resilience of OECD economies and achieving zero-carbon emission targets requires addressing these unpredictability issues, especially by shifting away from fossil fuels and toward renewable energy sources.

Concluding remarks

Global population increase, fast industrialization, and noncompliance with environmental standards are some elements contributing to climate change, posing severe concerns. To tackle these issues, several nations have pledged to decrease their carbon emissions using programs like the Global Roadmap for reaching "Carbon neutrality," which attempts to strike a balance between carbon emissions and absorption. This study examines how green funding and renewable energy sources affect 38 OECD member states' carbon neutrality goals between 2013 and 2021. The research yields several important conclusions. First, there is a positive connection between the lagged value of carbon neutrality and the variable's present value, a correlation of 0.749 indicates that higher green bond issuance in OECD nations corresponds to higher progress toward reaching carbon neutrality objectives. Furthermore, the deployment of renewable energy shows promise for attaining carbon neutrality; a 1% increase in renewable energy consumption is linked to a 0.048% gain in carbon neutrality. The advancement of green innovation is also significant; its influence is more important than deploying renewable energy, suggesting that it can improve the results of carbon neutrality objectives. Moreover, OECD nations' GDP per capita growth is positively correlated with their carbon neutrality, underscoring economic development's contribution to achieving sustainability objectives. Furthermore, raising the standard of governance may help OECD member states meet their carbon neutrality goals, highlighting the need for solid governance frameworks in guiding environmental policy. On the other hand, uncertainty is a significant barrier to carbon neutrality, with a negative coefficient suggesting that it hinders the achievement of sustainability objectives. This result emphasizes how important it is for decision-makers to deal with geopolitical unrest, economic uncertainty, and other issues impeding the pursuit of carbon neutrality. This analysis concludes by highlighting the crucial roles that green financing, the use of renewable energy, economic growth, high-quality governance, and uncertainty management have in determining how the OECD member states will go toward carbon neutrality. By using these results, policymakers may create efficient plans and policies to hasten the achievement of sustainability objectives and lessen the effects of climate change.

Policy implications

Several policy recommendations are made to help OECD member nations get closer to being carbon neutral. Considering the accelerated attainment of carbon neutrality goals via the issue of green bonds, one important suggestion is to give top priority to creating green finance markets among governments. This means carefully examining how the banking and non-banking financial sectors are promoting environmentally friendly financial products. Additionally, initiatives should concentrate on guaranteeing the market for green financing develops in a balanced manner and giving people and businesses access to clear information about prioritized green projects. By reducing temporal and locational barriers, an effective green finance market may assist in reducing the uncertainty around green projects, which can promote more investor interest and enable broader engagement in green activities. The sustainability of electricity production is a crucial policy subject, considering its substantial impact on worldwide CO2 emissions. The OECD's focus should be on policies that encourage the production of sustainable power. This includes developing precise plans for three crucial stages: Identifying viable renewable energy sources, funding the necessary infrastructure for producing renewable energy, and effectively employing available renewable energy resources. By gradually shifting towards more sustainable means of generating power, nations may lessen their dependency on fossil fuels and lower their carbon emissions. Governments should also encourage Small and Medium Enterprises (SMEs) to participate in green projects because of their creativity and adaptability. Policies like tax breaks, green guarantees, and green loans encourage innovation in the green industry and make it easier for SMEs to participate in sustainability initiatives. OECD nations may also effectively encourage carbon neutrality by using carbon market rules. Although several countries have set up carbon markets, these systems could be more effective due to flaws, including collusion, price manipulation, and green washing. For carbon markets to be more successful in reaching carbon neutrality goals, several changes must be implemented. The OECD nations can use the potential of carbon markets to produce significant reductions in carbon emissions and promote sustainability objectives by resolving these shortcomings and fortifying regulatory frameworks.

In the domain of carbon neutrality objectives, this study has made novel contributions and offered legislators helpful policy suggestions. Future research may go in several directions that could deepen our knowledge and help guide policy choices. One research topic is examining the fluctuating impact of the corona virus illness (COVID-19) on carbon neutrality. Numerous industries, particularly those for green finance and renewable energy, have been greatly influenced by the pandemic's economic and social aspects. Subsequent investigations may explore how the epidemic has impacted the correlation between these factors and attaining carbon neutrality. By integrating a COVID-19 control variable, scholars may provide significant perspectives on how external disruptions impact the advancement towards carbon neutrality.

More helpful information for policymakers may also come from examining the relationship. With this method, officials may discuss the variables affecting each nation's carbon neutrality objectives more precisely and adjust their action plans appropriately. By comprehending the distinct obstacles and prospects encountered by various states, policymakers may formulate more focused measures to expedite the advancement towards carbon neutrality. In addition, future studies might investigate the relationship between green funding and carbon neutrality in OECD nations by developing scenarios and using cutting-edge statistical techniques like artificial neural networks and machine learning. These advanced methods may assist in revealing intricate connections and spotting patterns that conventional statistical analysis alone would miss. Using machine learning, researchers can provide more precise forecasts and insights, which will help decision-makers reach their carbon neutrality objectives. Finally, by including expert views and a range of viewpoints, qualitative approaches to multi-criteria decision-making may be incorporated into future research to supplement quantitative findings. Qualitative methods may provide important insights into the arbitrary variables that affect carbon neutrality and green funding, such as public opinion, stakeholder participation, and policy efficacy. By integrating quantitative data and qualitative insights, scholars can comprehensively comprehend the obstacles and prospects of attaining carbon neutrality in OECD nations.

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]